|

|||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||

|

0.50 Rate hike Dec 2022

Posted by: Atish sAtish Thakur

Each Office Independently Owned & Operated

Posted by: Atish sAtish Thakur

|

|||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||

|

Posted by: Atish sAtish Thakur

Homeownership is one of the major values that many Canadians share. After all, it’s often seen as a major milestone in one’s life to be able to buy your first home. This is not surprising when you consider the many benefits of homeownership both financially and for quality of life.

Among Canadians, it’s the older generations who have the highest levels of homeownership, largely due to the fact that older people have had longer to become financially established. Similarly, younger people tend to have the lowest levels of homeownership as many are still working to become established financially and save for a down payment.

Most people who are saving to buy a home naturally want to do so as soon as possible, but this can take a long time. Statistics show that young people are buying homes often, though most first-time buyers are well into their 30s before they enter the housing market.

In this article, we will look at when the average first-time buyer purchases their home, how much they spend, and other important statistics of homeownership as it relates to age.

What is the average age of a first-time buyer?

If you are a young adult eager to make your way into homeownership, you may want to have some patience. According to a study conducted by Money.co.uk, the average age of a first-time homebuyer in Canada is around 36.

While that’s not too old, it’s pretty late when compared to other major life milestones. The average Canadian university graduate is around 25 years old. On average, mothers are about 29 when they have their first child and the average age for a Canadian couple to get married is around the same age. This means that buying a home may very well be one of the later major steps you take in life.

That doesn’t mean some aren’t buying homes younger. Statistics Canada indicates that around 43% of Canadians aged 20-34 own their home, however, this is about 30% lower than any other age demographic. They also note that young people today are getting into the real estate market at a much slower pace than older generations such as the baby boomers and increasingly more people are living with parents or family later in life.

How much do first-time buyers spend?

The same Money.co.uk study that determined the average age of a first-time homebuyer also polled buyers on how much they spent on their purchase. According to the results, the average first-time home buyer in Canada spent about $340,000, though this figure is a couple of years old and value will depend a lot on the area where the purchase is made. A more recent poll from the Bank of Montreal found that first-time buyers in Atlantic Canada planned to pay the lowest for their first homes, with those in British Columbia and Ontario expecting to spend the most.

A more recent market insight report from Teranet shows that first-time buyers spent the least of any buyers in Ontario. Their average home value was above $500,000 and over $600,000 in Toronto specifically.

The rapid increase in house prices in Canada has led many young people to feel that saving for a down payment is exceedingly difficult. As a result, some have had to turn to other options in order to purchase a home. For example, the number of first-time buyers using gifted money for a down payment has risen to just under 30%, while at the same time, the sizes of these gifts have risen as well according to a report from CIBC. Younger people also tend to make less money, and as a result, are more in the market for cheaper homes with both lower down payments and lower mortgage payments.

Beyond affordability issues, the discrepancy in home values may also simply be a reflection of lifestyle values for younger buyers. Many of the youngest buyers, will not yet have large families who need as much space and may opt for smaller homes. Young professionals without children may be more likely to buy comparatively cheaper condominiums, whereas growing families tend to prefer larger more expensive properties.

Furthermore, those who are buying a home at an older age are more likely to be moving from a home they already own, making it easier for them to leverage their existing equity into larger homes.

Who is buying the most houses?

While we explained earlier that young people tend to have a lower level of homeownership in Canada, this doesn’t tell the whole story. Remember, many people will buy their homes to live in for many years, some even for their whole lives. This means that though more older people own homes, they aren’t necessarily on the market right now.

This is backed up by a recent report from the Bank of Canada, which indicated that about half of all purchases from 2014 to 2021 were by first-time homebuyers, with the other half divided between repeat homebuyers and investors. However, the overall share of first-time homebuyers has been falling, especially in areas like Ontario and British Columbia where investor activity has been on the rise. The same internet report from before indicates that in Toronto, where home prices are some of the highest in the country, first-time buyers made up just 27% of sales with 24% alone going to multi-property owning investors.

How old should you be to buy your first home?

There is no right age to buy a home – it simply depends on when you can afford it based on your own circumstances. Based on the data covered in this article, we can offer some advice for first-time homebuyers hoping to begin their home buying process:

Buying young if you can

First of all, if you can afford to purchase a home and plan on living in it for many years to come, most experts would say to go for it. It can be one of the best financial investments you will make and will provide numerous lifestyle benefits as well. And, the sooner you buy, the sooner you can pay off your debt and the longer your home can build equity.

Be patient with yourself

For those still looking to buy or trying to save for a down payment, be patient. As covered before, purchasing a home can happen much later than many other life milestones, so don’t feel like you are behind if you don’t buy in your twenties and don’t feel too late if you are older than 36. Everyone achieves goals at different ages in their life so don’t feel the need to compare yourself to others too harshly. There is no set timeline for everyone to accomplish certain things.

First-time purchases are made easier with smart decision making

First-time homebuyers can make their purchase more attainable through careful choice of what they want to buy. The varying amounts of first-time buyers in different regions and the generally low spending of first-time buyers indicate that those who are successful in buying their first home made smart decisions about what and where to buy. Be realistic about your budget and remember you can always scale up later as your requirements change. Also, consider looking to buy in a cheaper area that may help you buy sooner.

Take advantage of first-time buyer programs

Finally, keep in mind there are many things you can do to help make your home purchase a little easier. Especially for first-time buyers, there are programs and incentives in place to ease your financial burden. Naturally, those who can get financial help will be the best off, but other federal, provincial, and municipal programs can go a long way to helping you get there faster.

Atish opinion:- with best tailored professional mortgage and Real estate advice that is specific to each client according to their financial need, can make very possibly to own a home in very early age. I have and are helping my client buying their first dream home from renter and others to move from their old home do brand new dream home even with reduced monthly mortgage payment (sometimes ) and others to buy multiple investment properties.

You can reach

www.bhumarealestate.com

www.bestmortgagevancouver.ca

at 604-653/9804, satishthakur.prec@gmail.com

Posted by: Atish sAtish Thakur

The tight real estate market is one of the biggest factors in the sky-high housing prices in most of Canada’s major cities. And it appears the real-estate wealthy Boomers are to blame for yet again disrupting markets.

More than 20 percent of Canada’s population will be 65 within the next five years. Many Boomers are still working and they are healthier than previous generations, so they aren’t yet ready to move into retirement communities or nursing homes.

Although the trend had already started and has been well-documented in the United States, the COVID-19 pandemic has exacerbated the problem in Canada, according to Engel and Volkers in their new 2021 year-end real estate report. Boomers witnessed the tragedy that occurred during the pandemic in Canada’s long-term care and retirement facilities and is wary of that future.

A 2020 Royal Society of Canada report that looked at long-term care in Canada during the early waves of the pandemic, highlighted its ruinous state. Canada experienced a far higher proportion of total country COVID-19 deaths in nursing homes than other comparable countries — 81 percent in Canada, compared to 28 percent in Australia, 31 percent in the US, and 66 percent in Spain..

By March of 2021, more than 50 percent of all deaths from COVID occurred in nursing and seniors’ homes, according to the Public Health Agency of Canada.

Hitt says Boomers are deciding to renovate or hire private help inside their homes. “Because of equity accrued in their homes, many can hire private help to ensure they can stay in the homes they own in communities they love for as long as possible.”

Almost two-thirds of local markets were sellers’ markets, and there were just 1.6 months of inventory on a national basis at the end of December 2021 — the lowest level ever recorded by CREA.

A report by the Bank of Nova Scotia found that Ontario, Alberta, and Manitoba have the lowest housing stock per capita.

Yet another factor cited in the trend for Boomers to stay in their homes has been the rise in reverse mortgages. Canadians aged 55 and over are able to draw on a portion of their home equity to boost their liquid income while staying in their homes.

HomeEquity Bank, a major provider of reverse mortgage products in Canada, recently disclosed that the country’s homeowners are now carrying more than $5 billion worth of its reverse mortgages, the largest amount ever.

Posted by: Atish sAtish Thakur

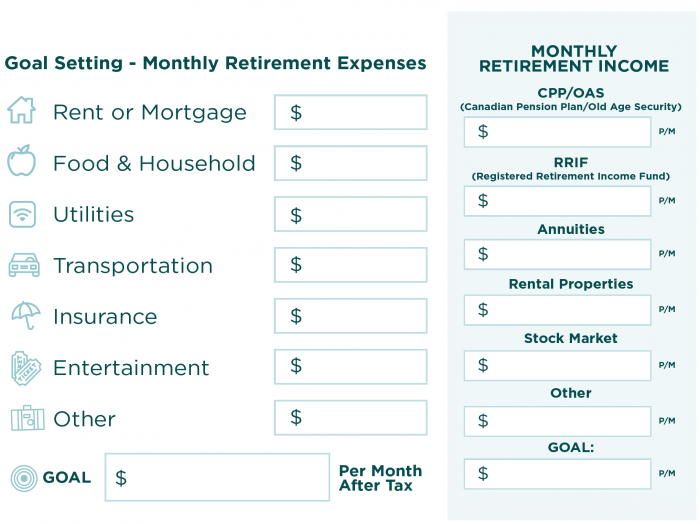

Thinking about retirement before it happens is just common sense. But what questions should you be asking yourself? While seeking the advice of a professional like a retirement advisor can be helpful, there are a few questions to start thinking about as you begin to plan.

Deciding early what your wants and priorities will be in your golden years will determine the steps you need to take now. Will travel be more important to you than having a house big enough for the whole family to visit? Will you want to live simply and not have several cars and a large house? Of course, wants and desires will change over the years, but having a set plan to begin with is a good idea.

What are your liabilities, income, and expenses? These will be considered when planning your retirement. You need to identify how much money you will need and where it will have to come from.

It is important to identify all possible income sources that will be available to you on the day you retire. Those could include pensions, RRSPs, savings accounts, government benefits, investment property you own, and your home. Keep in mind you don’t want to rely on the Canadian Pension Plan (CPP). The average payout is $20,000 or around $1,300, and is taxable.

If you think you’ve done everything right, life can bring surprises.

About 20% of retirees are found to be still paying for mortgages, while 66% are carrying credit card debt.

Had to retire early due to a health issue.

A heart attack or a bad back or hip can force people into early retirement. It doesn’t even have to happen to you…it could happen to a spouse and have the same devastating effect. There are a number of health reasons that could keep someone from continuing to work. Don’t rely on disability from the government to cover all your expenses. Make sure you are paying into a RRSP or other investment from an early age so that unexpected illnesses won’t keep you from the retirement you deserve.

Still had unsecured debt.

If you are not aware of your credit card balances, you just might carry that debt into your retirement where you weren’t counting on it still being an expense. It might not have even been a frivolous vacation or an out-of-control spending habit. It’s just the longer you have credit, the more the credit companies will throw at you, so it is best to pay off your balances every month as often as you can.

Still owed on a house and/or investment properties.

Again, retirement can sneak up on you or be forced upon you. When investing in property or managing the mortgage on your primary residence, keep this in mind. A 2nd mortgage might sound fine to pay for an elaborate vacation or to fund a grandkid’s wedding, but you will have to pay it back eventually.

Spent more money before retiring or after retiring than you should have.

People get excited at the prospect of not having to go to work anymore. They see a healthy sum of money in their retirement portfolio and decide they’ve earned a little fun. New cars, expensive vacations, purchasing vacation homes, etc. all will hit your retirement money in a big way. Stick to your retirement plan so your retirement can work for you.

written by MY DLC Marketing team

Posted by: Atish sAtish Thakur

The Governing Council of the Bank of Canada raised the overnight policy rate target by a quarter percentage point in a widely expected move and signalled that more hikes would be coming. This is the first rate hike since 2018. In a cautious stance, the Bank announced it was continuing the reinvestment phase, keeping its overall Government of Canada bonds holdings on its balance sheet roughly stable.

The Bank’s press release highlighted the major new source of uncertainty provided by the unprovoked invasion of Ukraine by Russia and suggested that it is a new source of substantial inflation pressure. Prices for oil, metals, wheat and other grains have skyrocketed recently. Moreover, this geopolitical distention negatively impacts confidence worldwide and adds new supply disruptions that dampen growth. “Financial market volatility has increased. The situation remains fluid, and we are following events closely.”

The Bank commented that economies have emerged from the impact of the Omicron variant more quickly than expected. Demand is robust, particularly in the US.

“Economic growth in Canada was very strong in the fourth quarter of last year at 6.7%. This is stronger than the Bank’s projection and confirms its view that economic slack has been absorbed. Both exports and imports have picked up, consistent with solid global demand. In January, Canada’s labour market recovery suffered a setback due to the Omicron variant, with temporary layoffs in service sectors and elevated employee absenteeism. However, the rebound from Omicron now appears to be well in train: household spending is proving resilient and should strengthen further with the lifting of public health restrictions. Housing market activity is more elevated, adding further pressure to house prices. Overall, first-quarter growth is now looking more solid than previously projected.”

Canadian CPI inflation has risen to 5.1%, as expected in January, well below the 7.5% level posted in the US.” Price increases have become more pervasive, and measures of core inflation have all risen. Poor harvests and higher transportation costs have pushed up food prices. The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities. All told, inflation is now expected to be higher in the near term than projected in January. Persistently elevated inflation increases the risk that longer-run inflation expectations could drift upwards. The Bank will use its monetary policy tools to return inflation to the 2% target and keep inflation expectations well-anchored.”

The final paragraph of the Bank’s press release speaks with great clarity: “The policy rate is the Bank’s primary monetary policy instrument. As the economy continues to expand and inflation pressures remain elevated, the Governing Council expects interest rates will need to rise further. The Governing Council will also be considering when to end the reinvestment phase and allow its holdings of Government of Canada bonds to begin to shrink. The resulting quantitative tightening (QT) would complement the policy interest rate increases. The timing and pace of further increases in the policy rate, and the start of QT, will be guided by the Bank’s ongoing assessment of the economy and its commitment to achieving the 2% inflation target”.

Bottom Line

The Bank of Canada has made a clear statement regarding the outlook for a normalization of interest rates. We expect a series of rate hikes over the next year. Expect another 25 basis point increase following the next meeting on April 13. The increased uncertainty and volatility arising from the war in Ukraine is front of mind worldwide. Still, it will not deter central banks from tightening monetary policy to forestall an embedded rise in inflation expectations.

The Bank of Canada has postponed Quantitative Tightening, for now, a prudent move in the face of geopolitical uncertainty.

Written by DLC Chief Economist Dr Sherry Cooper

Posted by: Atish sAtish Thakur

While home inspections might not be the most exciting part of your home buying journey, they are extremely important and can save you money and a major headache in the long run.

In a competitive housing market, there can sometimes be pressure to make an offer right away without conditions. However, no matter how competitive a market may be, you should never skip out on things designed for buyer protection – such as a home inspection.

You may have a good eye for décor and love the layout of your potential new home, but what is under the surface is typically where headaches can lie. We have all heard the expression “don’t judge a book by its cover” so why would you make the most important purchase in your life without checking it out?

In fact, there are five reasons that a home inspection might just be the best $300-$500 you ever spend.

When buying a new house, it is always best to avoid taking chances. While a house may look great on the surface, hidden structural issues such as cracked foundation or roof damage can easily turn into expensive repairs. A home inspection can help reveal any large and/or hidden issues, which can often provide an ‘out’ for the buyer.

If you find something that will cost a considerable amount to replace or repair you can go back to the seller’s agent and ask for a reduction in the price. A leaky roof may cost a few thousand to replace. Perhaps the seller would split the cost with you? It’s worth asking. If the price cannot be re-negotiated if issues come to light, then it is best to just walk away on the basis that the home will cost you too much in the long run.

Another benefit of having a home inspection is not only to find issues, but also to confirm structural integrity. During an inspection, the inspector will review everything from the attic to the furthest reaches of the basement and will look for things like mold, holes in the chimney, saggy beams or improper wiring.

Similarly to determining any safety and structural issues, home inspections can also reveal hidden additions or DIY installations that may cause trouble down the road. If the seller wired the house improperly or used substandard materials, it not only could cost you big in the future but it could even null and void your home insurance should something happen!

A home is an ongoing expense, much like a car. Unless it is brand new, there will be regular maintenance and updates required to replace things when they become old and inefficient. For instance, water heaters typically last for 6-10 years, the life of a good roof is around 20 years, while furnaces can last up to 25 years. The home inspection report will include an estimate on the remaining life for each of these big-ticket items, which will give you a heads up on future expected costs and provide you time to save for their eventual replacement.

Finally and perhaps most importantly, getting a home inspection is important for your own peace of mind. A home is a huge investment, and one that you will be paying off for 20 or 30 years. It is much easier to feel good about your investment after you have gone through a home inspection and you know that the house is safe and that you won’t run into any surprise problems down the road. While a home inspection isn’t free, peace of mind is priceless and a few hundred bucks is worth it!

Written by MY DLC Marketing Team